Property Profile

Unanchored neighborhood retail

10,000–50,000 square feet

Minimum 5-year operating history

Location Profile

Dense neighborhood population or significant daytime population

Robust household incomes in the immediate trade area

High traffic counts

Markets with economic stability including top 50 MSA’s, select college towns, or established tourist areas

Tenancy Profile

Lack of tenant concentration

Established local tenants

Internet and Amazon resistant uses (food and beverage, service, medical, etc.)

At or below market rents

Economic Profile

$2M to $25M

Stabilized or value add

Loan assumptions considered

Last Mile Advantage

45+ years of experience in shopping center investment and operations

A dedicated analyst team

Certainty of closing

Brokers protected

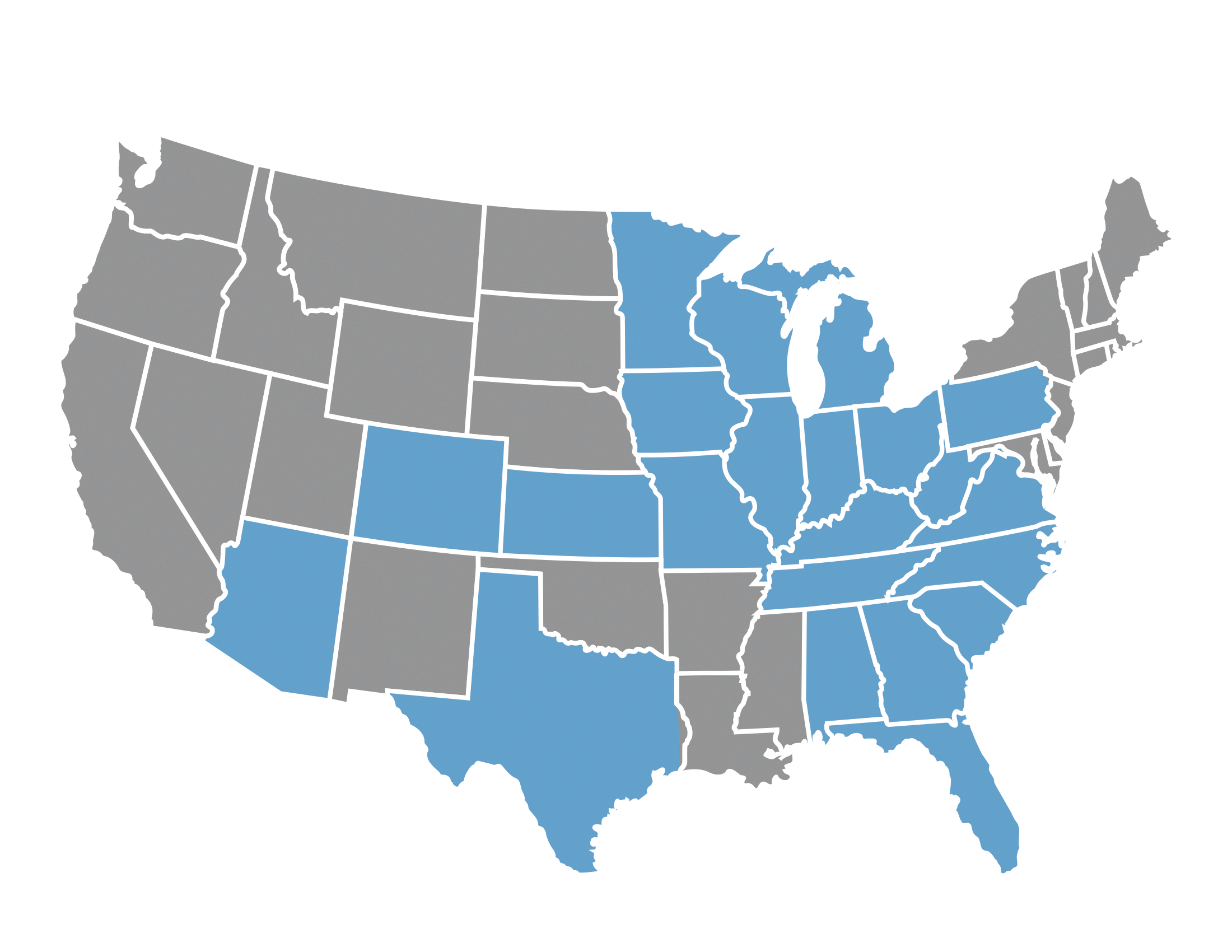

Target Markets

Strategic Acquisitions

In addition, Last Mile Investments targets high quality portfolios and companies with similar fundamentals as outlined above, including those where a portion is comprised of other asset types (mixed use, grocery, power, among others). Last Mile Investments is not limited geographically for these opportunities, thus will consider investments across the entire United States.